Parks and recreation facilities play a vital role in supporting public health, environmental resilience, and social connection – and sustaining this system requires reliable and diverse funding sources. Los Angeles’ parks receive funding from the City budget, voter- approved measures, grants, philanthropic partnerships, and earned revenue from programs and services. Together, these mechanisms support RAP’s ability to operate hundreds of parks, deliver programs for people of all ages, perform daily maintenance, and implement long-term capital improvements.

This section provides an overview of RAP’s current financial landscape based on interviews with RAP leadership and senior staff, as well as an in-depth analysis of budget, staffing, and operations data provided by the department. It explains RAP’s financial and operating challenges, including structural funding gaps, rising maintenance costs, and growing service demands, and evaluates funding strategies that could strengthen the department’s ability to maintain facilities, expand programming, and improve park access for all Angelenos. By understanding the current budget and finance conditions, the PNA aims to identify opportunities to build a more resilient and equitable funding model for the city’s recreation and parks system.

More in This Section

Financial Snapshot

The more than 16,000 acres of parks under the jurisdiction of RAP serve as vital spaces for millions of Angelenos to gather, play, exercise, and build community. Parks are essential to maintaining the quality of life in Los Angeles. Yet, like many major cities since the Great Recession, Los Angeles struggles with chronic underfunding of park maintenance, limiting its ability to steward existing parks and facilities and fully realize the potential of these critical public spaces. Interviews with RAP staff, a review of RAP budget documents, and benchmarking against peer cities revealed that:

- RAP’s operating budget is constrained by General Fund reimbursements. More than one-third (40%) of RAP’s operating budget in FY 2025-2026 is allocated to the General Fund to pay for staff benefits. This growing and significant amount limits the funds available for RAP to operate and maintain parks.

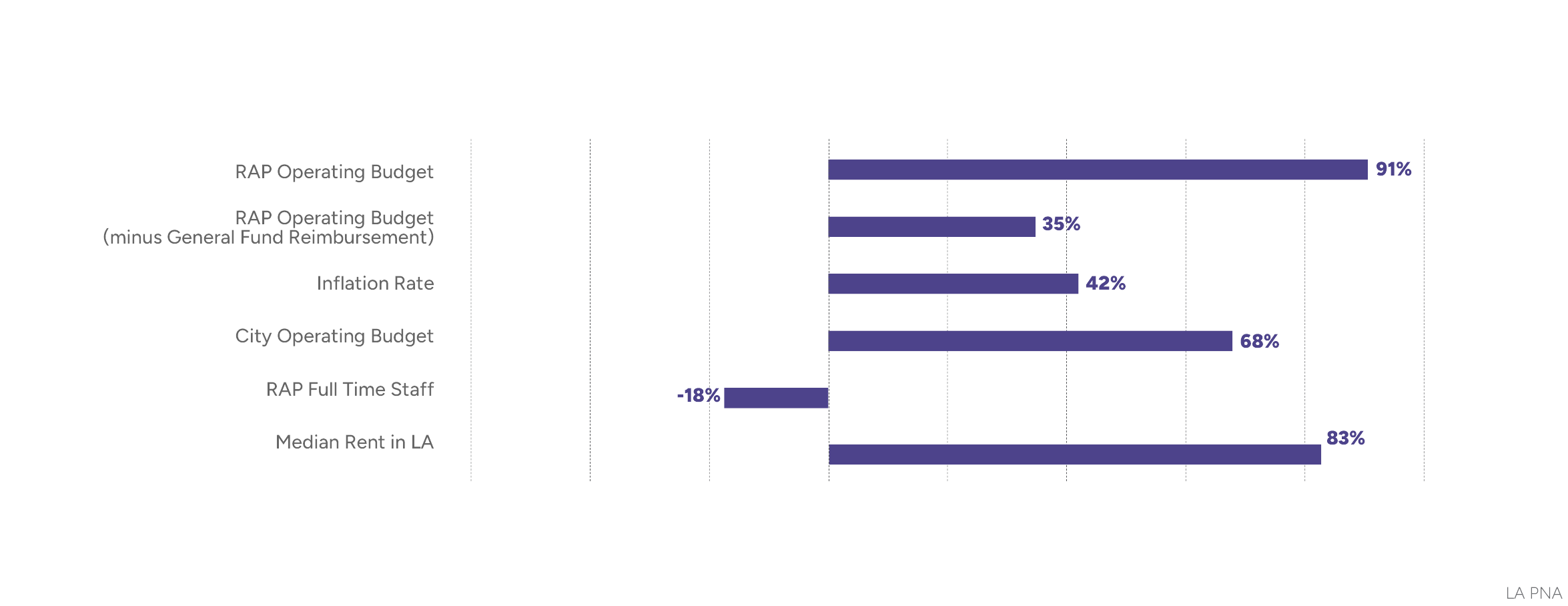

- RAP’s operating budget has increased more slowly than the City budget overall. While the City’s operating budget grew by 68% between FY 2009 and FY 2023, RAP’s operating budget grew by half as much (35%) over the same period after accounting for General Fund reimbursements.

- RAP manages a growing park system with a shrinking workforce, straining its ability to maintain facilities, offer programs, and care for parks and open spaces. Full-time staffing decreased by 28% and part-time staffing decreased by 62% between FY 2008 and FY 2025, while park space acreage and facilities have increased.

- The City of Los Angeles invests less in parks per capita than peer cities, limiting park quality, programs, and access. At $92 per-capita park investment, LA’s per-capita investment is lower than that of all other benchmarked cities.

To help ensure the accessibility, safety, and quality of Los Angeles parks, the City must explore sustainable and equitable funding solutions to address RAP’s budget challenges. New, dedicated funding streams for RAP could include voter- approved sales or property taxes, municipal bonds, or partnerships with nonprofits and conservancies. Additionally, RAP can leverage funds from aligned initiatives like Measure W to help close funding gaps. Ensuring adequate investment in LA’s parks is critical not just for parks and green space, but also supports public health, environmental resilience and

economic vitality throughout the City.

Charter-Mandated Funding

RAP is one of only two city departments—the other being the Library Department—for which the City of Los Angeles Charter explicitly provides financial support. Beginning in 1925, the charter required an appropriation of 7¢ per $100 in assessed value for the Department of Parks and 4¢ per $100 in assessed value for the Department of Playgrounds and Recreation.126 In 1937, the Department of Playgrounds and Recreation’s appropriation was increased to 6¢ per $100 in assessed value. A 1947 charter amendment merged the two departments into a new Department of Recreation and Parks, which was allocated 13¢ per $100 in assessed value—equal to the combined allocations of the two separate departments.

In 1978, the passage of Proposition 3 changed the property assessment ratio from 25% of total property value. In response, the City Charter was amended to adjust RAP’s appropriation by an equal amount to maintain its prior level of

funding, which equated to 3.25¢ per $100 in the newly assessed value. This was codified in the 1999 version of the City Charter approved by LA

voters.

OPERATING BUDGET

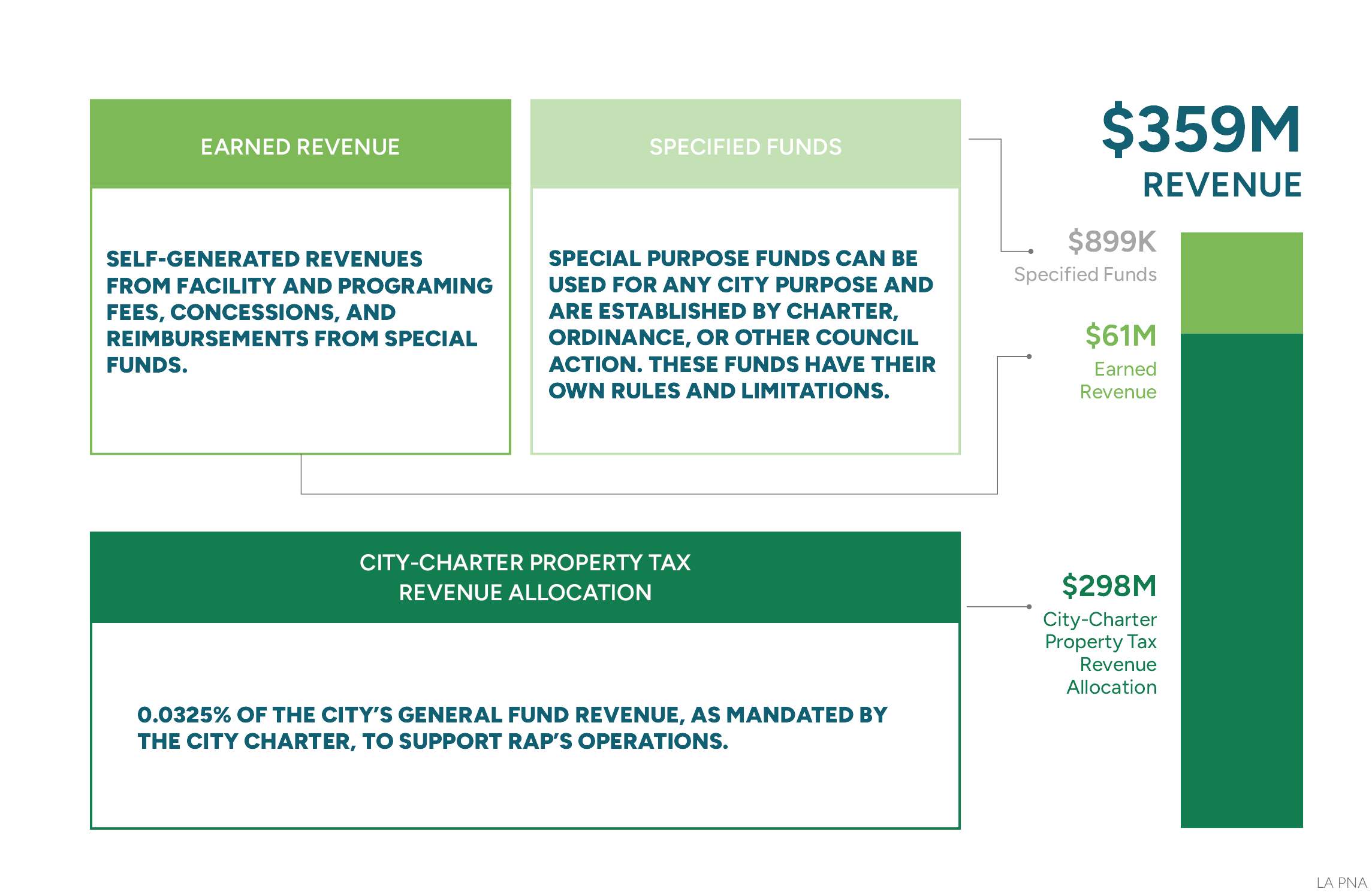

In FY 2025-2026, RAP’s operating budget totaled$359 million. RAP’s operating budget is funded by three sources: $298 million from the City-Charter property tax revenue allocation, $60 million from earned revenue (revenue generated by RAP-operated programs such as pool passes), and $285,000 from specified funds (Figure 113).

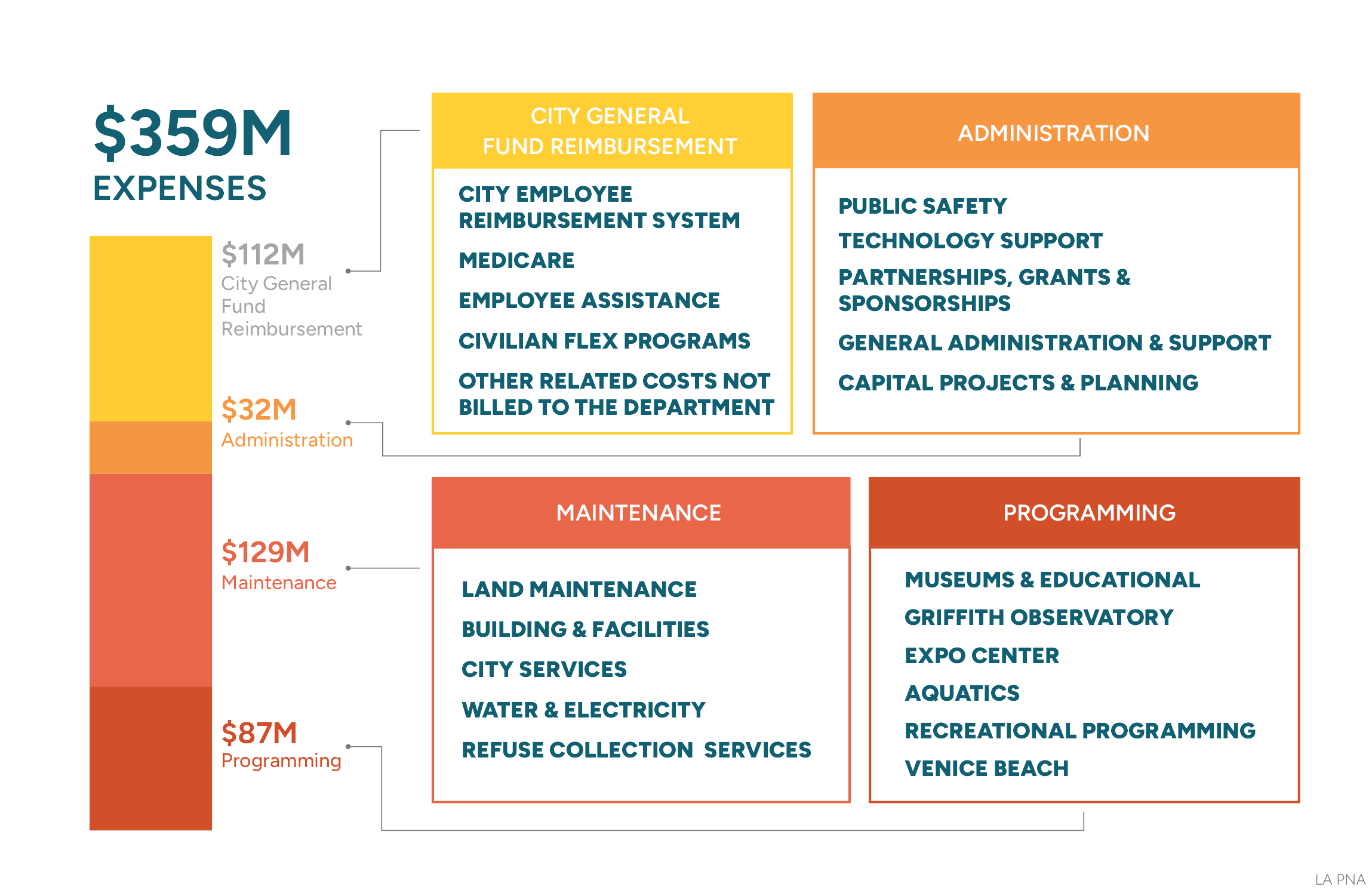

Major expenses for RAP were categorized into four categories: City General Fund reimbursements, Administration, Maintenance, and Programming (Figure 114). Since FY 2009, RAP has been required to reimburse its staff benefits, utilities, and trash costs back to the City General Fund. In FY 2026,

RAP allocated $145 million—equivalent to 40% of its total operating budget—toward mandatory reimbursements, including employee benefits ($112 million), utility costs to the Department of Water and Power ($31 million, captured in “Maintenance” below), and refuse collection services through

the Bureau of Sanitation ($3 million, captured in “Maintenance” below). As costs continue to rise, these required reimbursements place increasing strain on RAP’s financial resources, limiting its capacity to adequately maintain recreation and parks programming without proportional increases to operating revenue.

RAP is primarily a people-oriented department, with the majority of its budget allocated to personnel costs. Out of RAP’s FY 2025 budget (disregarding General Fund reimbursements), $184 million (83%) was dedicated to salaries and the remaining $39 million (17%) was allocated to operating expenses.

RAP's Operating Budget (without General Fund Reimbursement, Utilities, and Refuse) Over Time

Budget Changes over Time and Implications

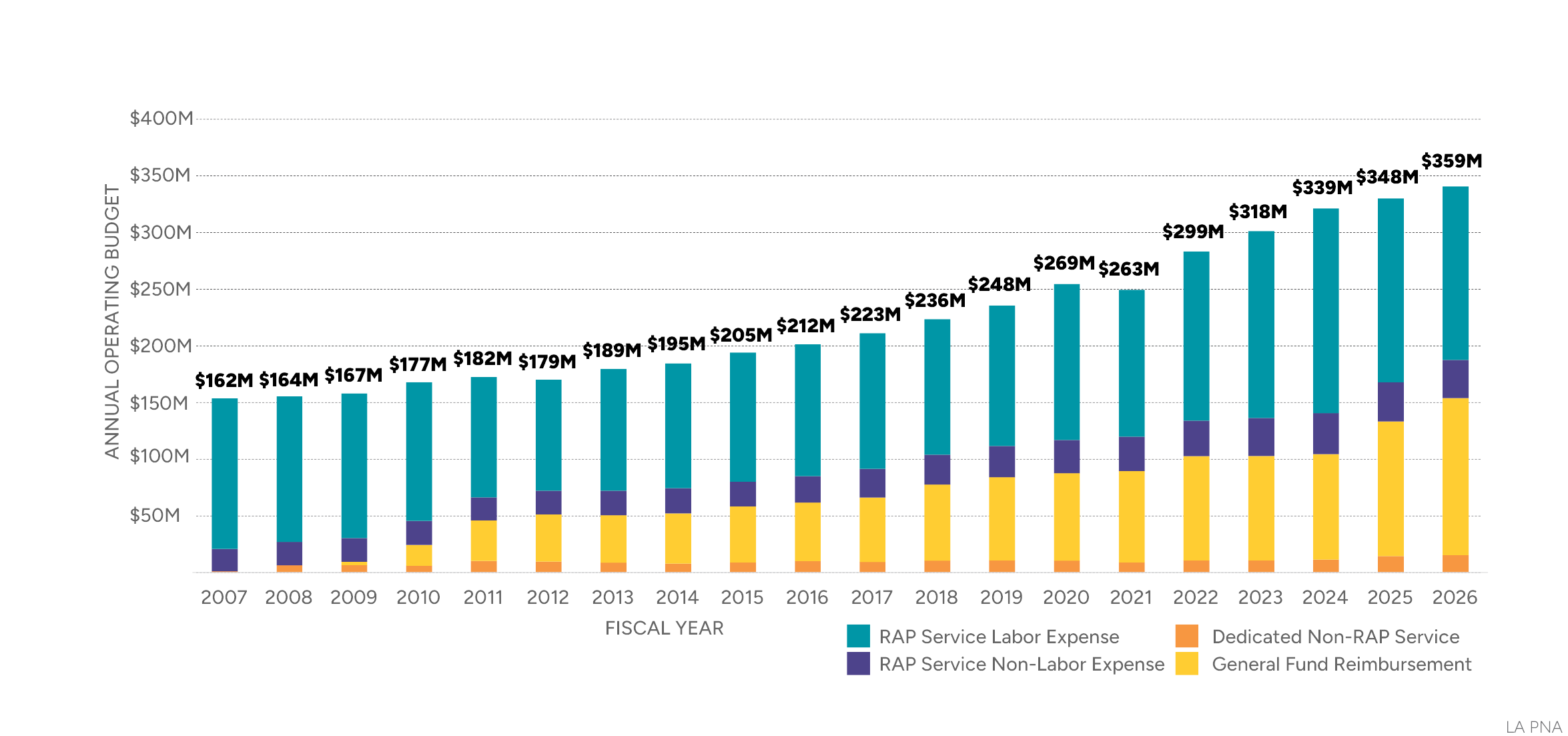

Over time, RAP’s overall budget has grown. RAP’s annual operating budget increased from $166 million in FY 2009 to $359 million in FY 2026 (Figure 98). However, most of the incremental increase is allocated to General Fund reimbursements.

The majority of the increase to RAP’s operating budget since FY 2009 has been to General Fund reimbursements rather than directly supporting park maintenance and services. Since the inception of these reimbursements in FY 2009, approximately $1.35 billion has been diverted from RAP’s core operations.133

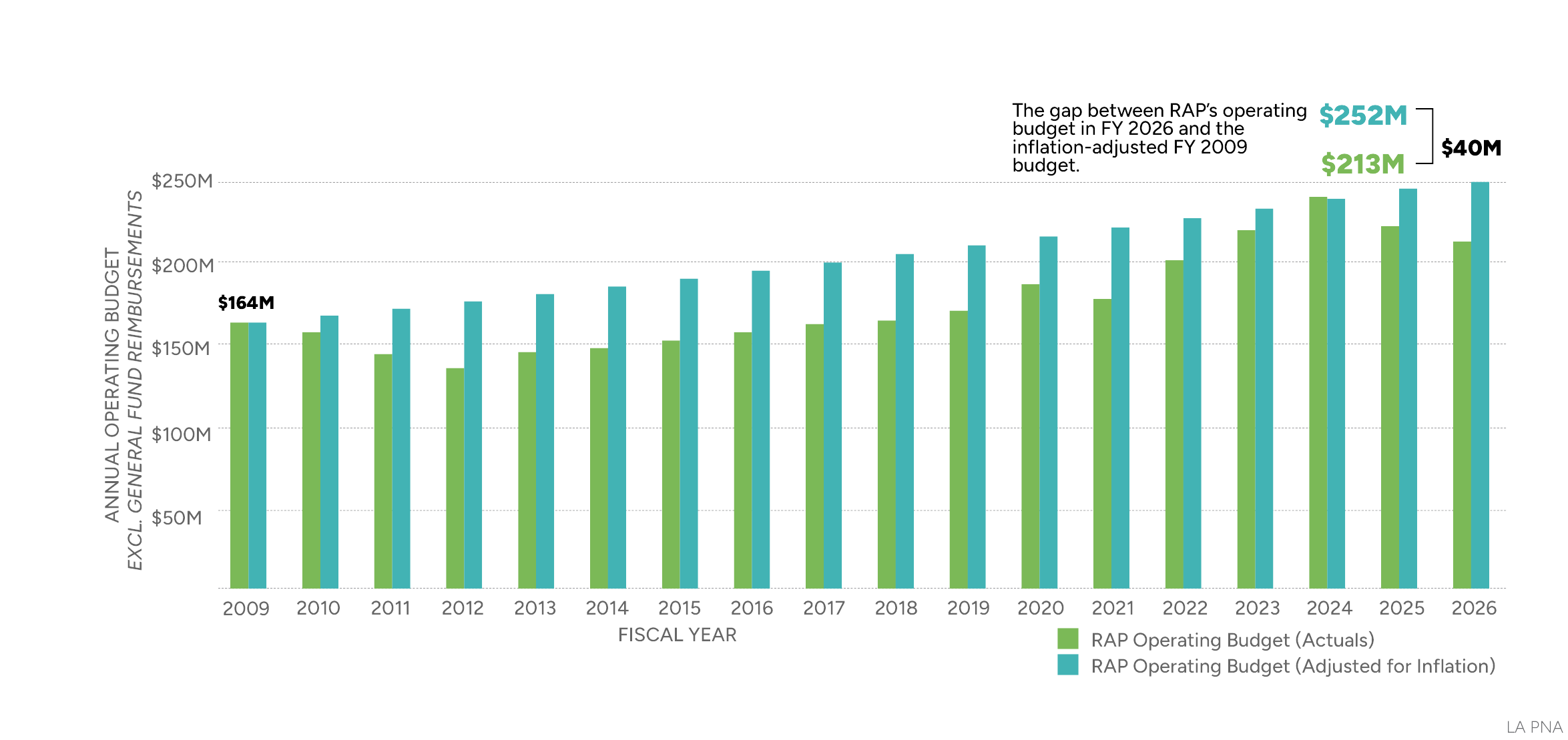

RAP’s discretionary operating expenses—those directly tied to service delivery—include RAP Service Labor Expenses and RAP Service Non-Labor Expenses (shown in purple in Figure 4). The discretionary expense budget has increased by $50 million since FY 2009 to $213 million as of FY 2026, an increase of 30%. If adjusted for inflation, the FY 2009 discretionary operating budget would be equal to $252 million.

However, when adjusted for inflation, RAP’s budget has effectively shrunk, creating a $40 million funding gap between the department’s FY 2026 operating budget and an inflation-adjusted FY 2009 budget (Figure 5). This limited growth further underscores the financial constraints limiting RAP’s ability to maintain and enhance the City’s recreation and parks facilities.

In addition to not keeping up with inflation, RAP’s budget has not kept pace with broader economic trends. Excluding General Fund reimbursements, RAP’s operating budget increased by only 35% between 2009 and 2023, falling behind the City’s total operating budget, which grew by 68% over the same period (Figure 100). Further, full-time staff positions and part-time staff positions have declined by 18% and 48% respectively since FY 2009. For both RAP staff and park visitors, this disparity is significant, as other key economic indicators, such as median rent in Los Angeles, have risen at a faster rate during this time.

Additional Park Funds and Funding

In addition to the operating budget, RAP is supplemented by additional funding sources for both capital and operations and maintenance (Figure 101). Looking ahead, RAP will face significant funding challenges with the expiration of Proposition K in 2026 and PlayLA in 2028. Simultaneously, the City is projecting a $1 billion budget deficit in FY 2026 and reduced property tax assessments resulting from the fires in January 2025 will reduce RAP’s City-Charter mandated assessment revenue.

Proposition K

Proposition K is property tax assessment that is expiring in 2026. Proposition K generates $25 million annually, of which $20.5 million is committed to capital projects and $4.5 million is dedicated to operations and maintenance.

Measure A

Measure A assessment revenue can be used for both capital as well as operations and maintenance. The County manages and administers Measure A funding on a reimbursement basis. However, reimbursements take multiple years for the County to process.

Quimby / Park Fees

As part of the Quimby Act, RAP collects in-lieu fees or land dedications for parks from new residential developments. Quimby funds can only be used for capital improvements or land acquisition and must be committed within five years. In 2017, an updated ordinance was passed, which created an “Early Consultation” meeting process with the City’s Planning Department. However, there are still difficulties with requiring developers to dedicate parkland. Currently, there is $200 million in uncommitted Quimby/park fees in the fund. Because of deferred maintenance throughout the park system as a result of a shrinking operating budget, Quimby/park fees are used on necessary health and safety repairs like roofs and HVAC systems. If maintenance was adequately funded, RAP could utilize Quimby/park fees for long-term capital improvements and large projects.

Grants

RAP receives funding from regional, State and Federal grants to support capital projects, and, to a lesser extent, operations and maintenance. The department has completed acquisition and capital rehabilitation projects with grant funding from State programs such as Proposition 40 (California Clean Water, Clean Air, Safe Neighborhood Parks, and Coastal Protection Act of 2002), Proposition 12 (Safe Neighborhood Parks, Clean Water, Clean Air, and Coastal Protection Bond Act of 2000), and Proposition 68 (Parks and Water Bond of 2018). Operational support has also been provided through grants like one from CAL FIRE, which funded arboriculture education and outreach initiatives.

Philanthropy & Friends Groups

RAP’s Partnership Division helps administer individual and organization donations to the city park system. RAP is supported by non-profits like the Los Angeles Parks Foundation. However, giving tends to be more prevalent in affluent areas of the City, and it takes a lot of staff time and energy to process donation agreements. The City has strict rules related to donor recognition which limits corporate sponsorships for signage.

PlayLA

As part of hosting the Olympics in 2028, LA received a commitment of $160M in funds to support youth sports and recreation through PlayLA. Youth sports and recreation are heavily subsidized by PlayLA, which makes them accessible to low-income families throughout LA. PlayLA funding will expire in 2028.

LA's Broader Fiscal Outlook

Lastly, compounded by wildfires, increased City liability expenses, and projected City budget shortfalls; the City is projecting a citywide operating deficit in FY 2026. This citywide context limits the potential for additional funds for RAP from the City and underscores the need for dedicated, long-term reliable funding for park capital and operations and maintenance.

| Source | FY 2025 Amount | Type | Description |

|---|---|---|---|

| Proposition K | $25 million (of which $4.5M goes to Prop K Maintenance Fund) | Capital, O&M | Property Tax Assessment - Expires in 2026 |

| Measure A | Varies | Capital, O&M | Property Tax Assessment (Countywide) |

| Quimby / Park Fees | $39.4M | Capital | Park Dedication In-Lieu Fee |

| Grants | Varies | Capital, O&M | Grants |

| Philanthropy and Friends Groups | Varies | Capital, O&M | Contributed Income |

| Play LA | $30.5M | O&M | Grants |